Step-by-Step Guidelines for Finishing Your Online Tax Return in Australia Without Errors

Step-by-Step Guidelines for Finishing Your Online Tax Return in Australia Without Errors

Blog Article

Trouble-free Tax Season: The Benefits of Declaring Your Online Tax Obligation Return in Australia

The tax obligation period can often feel frustrating, yet filing your tax return online in Australia supplies a streamlined method that can ease a lot of that anxiety. With user-friendly systems provided by the Australian Tax Workplace, taxpayers profit from features such as pre-filled details, which not just streamlines the process yet likewise enhances accuracy.

Simplified Filing Refine

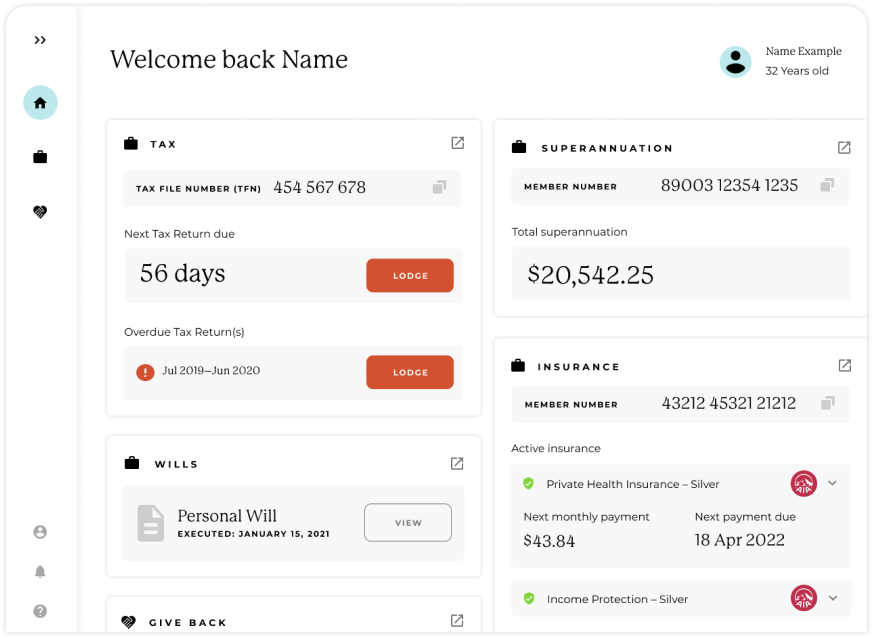

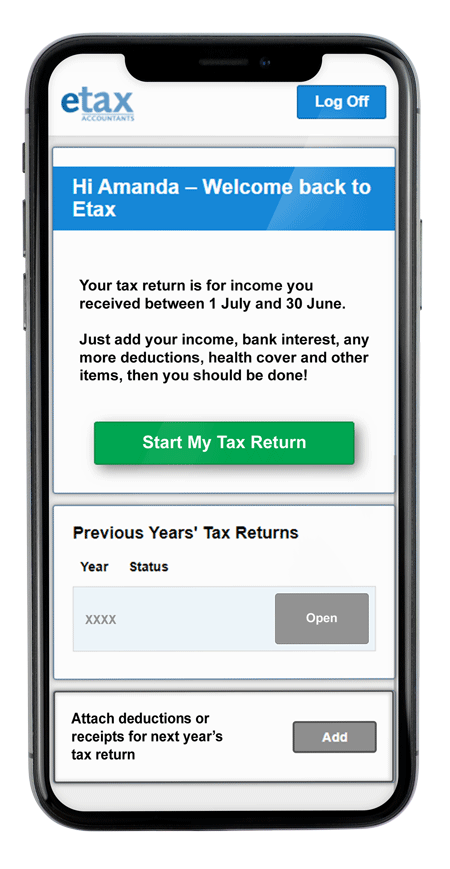

Many taxpayers often locate the online tax obligation return procedure in Australia to be simple and effective. The Australian Tax Workplace (ATO) has created an easy to use online system that streamlines the filing procedure. Taxpayers can access their accounts via the ATO website or mobile app, where they are led step-by-step via the submission process.

Furthermore, the online system is available 24/7, offering versatility for taxpayers to submit at their comfort. Using safe technology makes sure that personal details stays secured throughout the process. By removing much of the complexities related to typical paper kinds, the on-line income tax return procedure not only enhances quality yet likewise empowers taxpayers to take control of their economic coverage with confidence. This simplified declaring procedure is a significant improvement, making tax obligation season much less discouraging for Australians.

Time-Saving Advantages

The online tax obligation return procedure in Australia not just streamlines declaring but additionally uses considerable time-saving benefits for taxpayers. Among the most remarkable advantages is the ability to finish the whole procedure from the comfort of one's home, getting rid of the requirement for in-person consultations with tax obligation specialists. This benefit permits people to choose a time that suits their routines, resulting in increased effectiveness.

Furthermore, online systems commonly provide straightforward interfaces and step-by-step support, which aid taxpayers browse the complexities of tax filing without considerable prior knowledge. The pre-filled information used by the Australian Taxes Workplace (ATO) even more simplifies the procedure, enabling customers to swiftly validate and update their details rather than going back to square one.

Another benefit is the instant accessibility to sources and support via online aid sections and discussion forums, allowing taxpayers to resolve inquiries immediately. The capability to save development and return to the return at any time additionally adds to time efficiency, as customers can manage their workload according to their individual dedications. Generally, the on the internet tax return system dramatically lowers the time and initiative called for to meet tax obligations, making it an appealing option for Australian taxpayers.

Improved Accuracy

Improved precision is a significant benefit of filing tax returns online in Australia (online tax return in Australia). The digital systems used for online tax entries are developed with built-in checks and recognitions that decrease the danger of human error. Unlike typical paper methods, where manual calculations can bring about mistakes, online systems immediately execute calculations, ensuring that figures are correct before entry

Moreover, lots of online tax services offer attributes such as data import alternatives Look At This from prior tax obligation returns and pre-filled info from the Australian Taxes Workplace (ATO) This combination not just simplifies the process yet additionally boosts accuracy by decreasing the requirement for manual information access. Taxpayers can cross-check their information extra effectively, significantly decreasing the chances of mistakes that could cause tax responsibilities or postponed reimbursements.

In addition, online tax obligation declaring systems usually give instant responses concerning prospective inconsistencies or noninclusions. This proactive method enables taxpayers to correct concerns in real time, ensuring compliance with Australian tax obligation regulations. In summary, by choosing to file online, individuals can gain from a much more exact income tax return experience, eventually adding to a smoother and much more effective tax obligation period.

Quicker Refunds

Filing income tax return online not important site just boosts precision however additionally accelerates the reimbursement procedure for Australian taxpayers. Among the significant benefits of electronic declaring is the rate at which reimbursements are processed. When taxpayers submit their returns online, the information is sent straight to the Australian Tax Workplace (ATO), minimizing hold-ups related to documentation handling and handbook handling.

Generally, on the internet tax returns are refined quicker than paper returns. online tax return in Australia. While paper submissions can take a number of weeks to be assessed and settled, digital filings usually lead to reimbursements being issued within an issue of days. This efficiency is particularly useful for people who depend on their tax obligation reimbursements for crucial expenditures or economic planning

Eco-Friendly Alternative

Choosing online tax obligation returns presents an eco-friendly choice to conventional paper-based filing methods. The shift to electronic processes considerably reduces the reliance theoretically, which consequently diminishes deforestation and lowers the carbon footprint related to more helpful hints printing, delivery, and storing paper records. In Australia, where ecological worries are increasingly critical, taking on on-line tax obligation declaring straightens with wider sustainability objectives.

Additionally, digital entries decrease waste generated from printed envelopes and forms, contributing to a cleaner setting. Not just do taxpayers gain from a more reliable filing procedure, however they also play an energetic duty in advertising eco-conscious methods. The electronic technique permits prompt access to tax obligation records and records, eliminating the need for physical storage space services that can consume additional sources.

Conclusion

In verdict, filing tax obligation returns online in Australia provides many advantages, including a structured process, significant time cost savings, enhanced accuracy with pre-filled information, expedited reimbursements, and an eco-friendly technique. These attributes collectively enhance the total experience for taxpayers, promoting an extra efficient and lasting method of taking care of tax obligation responsibilities. As digital options remain to advance, the benefits of on-line filing are likely to end up being significantly noticable, more motivating taxpayers to accept this modern technique.

The tax obligation season can commonly really feel overwhelming, but submitting your tax obligation return online in Australia offers a structured technique that can alleviate much of that tension. Generally, the on-line tax obligation return system considerably minimizes the time and effort needed to accomplish tax obligation commitments, making it an enticing option for Australian taxpayers.

In addition, lots of online tax obligation solutions supply features such as information import alternatives from previous tax returns and pre-filled information from the Australian Tax Office (ATO) In summary, by selecting to file online, people can benefit from a much more exact tax return experience, ultimately contributing to a smoother and much more reliable tax season.

Generally, on the internet tax returns are processed much more rapidly than paper returns.

Report this page